Owning a rental home in Orlando means navigating a market that changes with the calendar. Unlike a fixed rent that never budges, dynamic rent pricing involves adjusting your asking rent based on seasonal demand, school schedules, and even local events. Why bother? Because timing is everything – setting the right rent at the right time can mean the difference between a quick, profitable lease-up or a month(s)-long vacancy. This strategy-focused guide will show Orlando landlords (especially those with single-family homes) how to fine-tune rent prices throughout the year. We’ll explore how Orlando’s leasing demand shifts by season, what months are best for lease starts (and which to avoid), and how to adjust your rent up or down based on timing. By understanding patterns like the school calendar, holidays, UCF’s academic cycle, Disney’s tourism surges, and snowbird seasonality, you can maximize your rent income while minimizing vacancy. Let’s dive into Orlando’s seasonal rental rhythms and pricing tactics to help you stay one step ahead of the market.

Orlando Rental Demand Fluctuates by Season

Orlando might have a warm climate and year-round attractions, but its rental market still has busy seasons and slow seasons. Broadly, summer is peak leasing season in Central Florida, whereas winter brings a slowdown. Many factors drive this cycle – the school year, holiday periods, tourism ebbs and flows, and even migration patterns. Understanding these trends is the first step to pricing your rental dynamically.

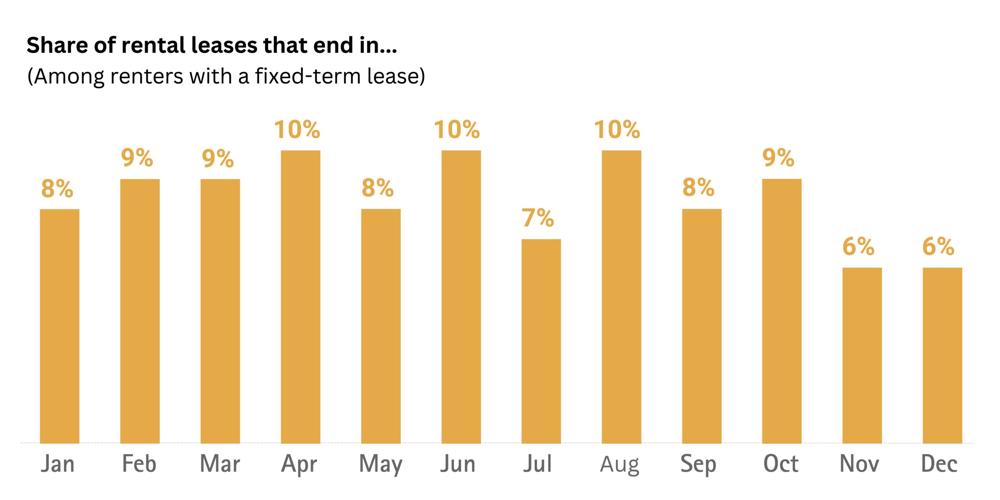

Seasonal lease turnover trends highlight the peaks and valleys of rental demand. The chart above shows the percentage of U.S. leases that end in each month. Notice the dip in late fall and winter – less than 7% of leases end in November or December, versus around 10% in August (a peak month). Orlando follows a similar pattern because most renters avoid moving during the school year or the holidays. Demand builds up and concentrates in the summer, while the pool of prospective tenants shrinks in the winter off-season.

Summer (Peak Season): The period from roughly May through August is the busiest time for rentals in the Orlando area. This is largely due to the school calendar – families prefer to move during summer break so children can start the new school year without interruption. In fact, May to September see the highest rental activity, as many families look to settle in before classes begin in August. Properties (especially single-family homes in desirable school districts) tend to rent faster and often at premium rates during summer, with multiple applicants competing for the same home. It’s not uncommon for a well-priced rental to get snapped up in days during July or early August. Additionally, late summer brings an influx of college students – for example, the University of Central Florida’s fall term means thousands of students securing housing in July/August near campus. All this contributes to summer being the prime time to fill vacancies in Orlando.

Fall (Cooling Off): Come September and October, the frantic summer rush subsides. By early fall, most families have settled in for the school year, and fewer people are relocating unless it’s for a job or personal reason. The Orlando rental market cools noticeably in the fall, with fewer inquiries coming in and listings taking longer to fill. If you list a rental in mid-fall, you might notice less foot traffic compared to a summer listing. That said, fall isn’t dead – young professionals or others without school-age kids might take advantage of the calmer market to move. Also, toward late fall, snowbirds begin trickling back to Florida for winter. Central Florida isn’t as snowbird-centric as coastal areas, but some retirees do start arriving by November, which can slightly bump up demand for certain rentals. For the most part, though, fall is a shoulder season where smart landlords prepare for the next cycle (more on that later).

Winter (Slow Season): November through January are typically the slowest months for Orlando rentals. The reasons are clear – few people want to uproot during the holiday season, and families are in the middle of the school year and won’t move unless absolutely necessary. Demand hits a low around late November, December, and early January (especially the period around Thanksgiving to New Year’s) when most folks pause their housing searches. Homes listed in winter generally take longer to rent out and may only get lukewarm interest. It’s common to see landlords lower asking rents a bit in winter to attract the limited number of renters actively looking. In fact, rental data in Orlando shows the same property might command about $50–$100 less in winter than it could in the summer peak. Days on market also stretch out in winter – a house that might lease in one week in July could take several weeks to find a tenant in December. Even though Orlando doesn’t have brutal winters, the rental market still experiences this holiday slowdown. (One silver lining: with so many landlords avoiding winter listings, any well-priced home that is available faces less competition, improving its odds of finding the few renters who are looking.)

Spring (Ramping Up): The cycle begins anew in spring (March through May). After the winter lull, renter demand starts rising in spring as people prepare for summer moves. Many families and relocating professionals start their housing search in the spring so they can move by early summer. Orlando’s spring weather also makes house-hunting pleasant (and gives your property nice curb appeal with blooming lawns). By mid-spring, you’ll notice more inquiries – it’s the lead-up to peak season. In other words, spring is an ideal time to start marketing a coming vacancy, as you’ll catch those early-bird renters who want to lock in a place for June or July.

In summary, Orlando’s rental demand follows a predictable seasonal rhythm: high in late spring and summer, slower in fall, lowest in winter, then rising again in spring. These patterns are driven by the school calendar, weather/holiday preferences, and local population cycles. There are also unique local factors to consider:

School Schedules: The K-12 school calendar is huge in Orlando’s rental timing. As noted, families overwhelmingly target summer for moves. “The school calendar heavily drives local moving habits”, with parents timing leases to avoid mid-year disruptions. If your target tenants are families, expect most of your turnover in May–August and almost none in Dec–Feb.

University Move-Ins: Orlando is home to large colleges like UCF (with ~68,000 students) and others. The academic calendar creates its own mini-season – peak leasing in spring/summer for fall semester occupancy. If you own rentals near UCF or other campuses, August is like a second “summer rush” as students flood back. Conversely, if you miss the August window, you may have to wait until the next semester or offer a short lease, since few students move in October or March except for those specific academic terms.

Tourism & Theme Park Cycles: The greater Orlando economy is influenced by Walt Disney World, Universal, and other theme park tourism. The good news is that tourism provides a steady stream of jobs and residents year-round – Orlando isn’t a pure “seasonal resort town” that empties out in off-months. However, there are still surges: Summer vacation and the winter holidays bring tourist booms, during which Disney and other employers often ramp up seasonal hiring. This can lead to an influx of short-term workers or participants in programs (like the Disney College Program) looking for temporary housing. These folks might fill roommate situations or month-to-month rentals, slightly boosting demand in those peak tourist periods. After the holidays, when tourism calms down (e.g. the slower park season in September and early fall), that extra demand from seasonal workers tapers off. So while the theme parks keep Orlando’s rental market from ever getting truly “cold,” their busiest and quietest times do add to the seasonal peaks and troughs.

Snowbird Season: Every winter, Florida sees an influx of snowbirds – retirees from up North (and Canada) who spend the winter months in the Sunshine State. In Central Florida, snowbirds typically arrive around November and stay through March. However, most snowbirds rent short-term or seasonally, often in furnished condos or 55+ communities, rather than signing annual leases for single-family homes. This means the snowbird influx doesn’t dramatically increase demand for your year-long rental – a retired couple from Michigan isn’t likely to take a 12-month lease starting in December, as they’ll head home in spring. It does, however, mean January and February have a bit of baseline occupancy in the region (the area is lively with seasonal residents), and in some niches (like if you own a suitable property you’re willing to lease for 3–6 months), you might capitalize on winter snowbird demand. For most traditional landlords though, it’s simply useful to know that Florida’s winter “high season” for tourism is actually a low season for long-term rentals – the locals stay put while the visitors fill hotels and short-term rentals.

The bottom line? Orlando’s rental market is dynamic throughout the year. Even though our city has strong demand overall (around 95% of rental units occupied on average), seasonality still impacts how quickly and at what price you can fill a vacancy. By recognizing when the tides of demand will be highest or lowest, you can plan your leasing strategy accordingly – which brings us to our next point: choosing the best timing for your leases.

Best Times for Lease Starts (and Avoiding the Worst Times)

One of the smartest moves you can make as a landlord is timing your lease start/end dates to sync up with strong market demand. In Orlando, that means aiming for spring and summer – and avoiding the dead of winter – when scheduling tenant move-outs and renewals.

Target Peak Months for Turnover: Ideally, you want your rental to become available in late spring or early summer. Data shows that the best time for a turnover in Orlando is the late spring or early summer – ideally May or June. If you can list a vacant home around May, June, or July, you’re hitting the market when tenant demand is near its peak. As we discussed, May–August are the busiest leasing months in Central Florida. You’ll have a larger pool of prospective renters, which usually means faster leasing and better rent rates. Many Orlando landlords will even prefer a slightly longer or shorter lease term with a current tenant in order to land in this sweet spot. For example, you might extend a tenant’s 12-month lease by 3 extra months (making it end in June instead of March) so that if they leave, you re-list in summer. Or if you’re signing a brand-new lease in spring, consider making it, say, a 15-month lease ending the next summer (rather than the next spring). The goal is to line up your turnover with high-demand months, giving you the advantage of peak season competition.

Avoid Winter Vacancies: Conversely, try your hardest not to have your property sitting empty in November, December, or January. These are hands-down the toughest months to find a new tenant in Orlando. If a lease would normally end in one of those months, proactively adjust the term to steer clear of a winter gap. For instance, if you have a lease scheduled to end in December, you might renew it for an extra 6 months (ending the following June) or even an 18-month term ending the next summer. This strategy ensures your next vacancy will come due when renters are out shopping instead of during the holiday hibernation period. As one Orlando property manager advises, don’t let a lease end in the slow season if you can help it – make it an 18-month lease instead of 12 to push the turnover into a more advantageous month. It may feel odd to sign an “odd” lease length, but it’s a worthwhile tactic to protect yourself from a hard-to-fill winter listing.

If you do find yourself with a vacant home in the winter, consider creative solutions: short-term extensions, renewals, or interim leases. For example, if a great tenant’s lease is up in December, you might offer a 3-month extension to get them through winter (perhaps at the same rent to encourage them to stay), with the lease then ending in March – at which point you could advertise in spring. Even if a tenant plans to leave, you could negotiate for them to stay an extra month or two (maybe month-to-month at a slightly discounted rate) just so you aren’t stuck listing the home over the holidays. It’s better to collect a bit less rent in December/January from an existing tenant than to have no rent at all and then struggle to re-fill the property. In short, keep your lease calendar in mind from day one: whenever possible, align your leases to end in high-demand months. It’s a preventative measure that can save you a lot of stress and lost income.

Let’s summarize the best and worst months for starting or ending a lease in Orlando:

Best months: May, June, July, August (and even into September) – high demand, easier to find tenants, typically stronger rent prices. Many leases naturally turn over in these months, and renters prefer them, so aim to have your property available during this window.

Decent months: March, April, September, October – moderate demand. Spring (Mar/Apr) is on the upswing toward peak, so those can work well (especially April). September/October are on the downswing after summer, so a bit slower but not as bad as deep winter. You might need slightly more patience or a small price tweak in early fall, but you can still find good tenants, especially those who didn’t secure a summer move.

Worst months: November, December, January, (and to a lesser extent February) – low demand, peak holiday and school session time. These are the months to avoid for new listings if you can. If a lease would end here, try to adjust it. If you must list during these months, be prepared for it to take longer and likely to price more competitively (we’ll cover that next).

By timing your lease expirations proactively, you’ll have an easier job when it’s time to find the next tenant. Now that we know when you should ideally be marketing your rental, let’s talk about how to price it dynamically for the season.

Dynamic Rent Pricing Strategies for Every Season

Pricing a rental isn’t a one-and-done task – a savvy landlord will adjust the rent strategy based on the time of year and market conditions. Dynamic pricing means raising your rent (or holding firm) when demand is high, and offering small discounts or incentives when demand is low. The aim is to maximize what you earn without overshooting the market and ending up vacant. Below are some key pricing strategies tailored to Orlando’s seasonal trends:

Leverage Peak Demand to Maximize Rent: During high-demand months, you can afford to be more aggressive with your asking rent. In summer, when multiple renters are competing, well-priced homes often attract strong interest and can fetch top dollar. If your property is in great shape and comparable rentals are getting, say, $2,400, you might list at $2,450 in July and still rent it out quickly. Capitalizing on peak season can be the best time to implement a rent increase (if you’ve been considering one) – renters expect prices to be a bit higher in summer because everyone is looking then. However, don’t stray too far above market value: even in summer, an overpriced rental can backfire. Renters will compare your rate to similar homes, and if you’re asking way more, they’ll pass you over despite the overall demand. In a competitive market like Orlando, tenants have options; a $2,500 asking rent will sit vacant if similar homes are $2,300 and offer equal value. So, use peak season to your advantage, but price within reason. If anything, focus on showcasing your property’s strengths (school district, new upgrades, etc.) to justify the top-of-market rent you want. When the renter pool is large, the right price + a good listing will likely have your phone ringing off the hook.

Stay Competitive in Slow Months: In the winter or early spring doldrums, it pays to be a bit more flexible on rent. When demand shrinks, pricing slightly under the market can make your property stand out to the few tenants shopping. Often, a $50 discount off your ideal rent is enough to draw in a renter in the off-season[1]. Remember that in December or January, renters have more bargaining power (because landlords are more desperate to fill units). If your home is asking $1,900 and similar homes are sitting empty at $1,950, a savvy tenant will gravitate to you. Data backs this up: Orlando landlords typically see winter rents about $50–$100 lower than summer for the same home in order to entice renters. Don’t view this as a loss – view it as avoiding a much bigger loss (vacancy). For example, collecting $1,900 instead of $2,000 for 3 months of winter is far better than holding out for $2,000 and getting nothing for those months. The small winter discount keeps cash flowing, whereas stubbornly sticking to a high price in an empty house will cost you more in the long run. So, when the renter pool is thin, price to fill. You can always reevaluate and nudge the rent back up once the lease comes up for renewal in a better season.

Use Small Discounts to Avoid Vacancies: One of the core principles of dynamic pricing is knowing when to drop the price just enough to prevent a vacancy. An empty month is extremely costly – think of it this way: one month vacant = 8.3% of your annual income gone (that’s 1/12 of the year)[2]. Any rent concession less than 8% per month is financially better than letting even a single month go by empty. In practical terms, for a $2,000/month rental, 8% is $160. If you reduce the rent by $100 (5%) and fill the unit immediately, you’re still coming out ahead versus being vacant for a month (losing $2,000). Even a $50 drop (just 2.5%) can make a difference in attracting a renter and will pay off over the year compared to an extended vacancy. For example, an Ackley Florida case study showed that taking $50 off the monthly rent earned the owner $1,900 more over the year than holding firm and remaining vacant for an extra month[3]. The math doesn’t lie: a minor discount now protects your annual ROI. So if your place isn’t renting, ask yourself – would I rather miss out on $100 a month, or $1,500+ for a vacant half-season? Nine times out of ten, you’re better off lowering the rent slightly and getting someone in there. The key is to make data-driven decisions, not emotional ones – don’t take it personally that you’re getting $50 less than you wanted; be happy you avoided losing a whole month of income. (If you enjoy number-crunching, you can even plug scenarios into a rent-vs-vacancy calculator to see the break-even point, as some property managers do. But the rule of thumb is clear enough: a discount under ~8% is usually a win if it prevents a vacancy.)

Monitor Days on Market and Pivot Quickly: Dynamic pricing isn’t a set-it-and-forget-it approach – you need to actively monitor how your listing is performing and be ready to adjust. A good practice is to watch your “Days on Market.” In Orlando’s current climate, a well-priced rental in a desirable area will often get snatched up within about 10–14 days, sometimes even faster in summer. If you’ve had two+ weeks of hardly any inquiries or only unqualified applicants, that’s a flashing warning sign that your price may be too high. Don’t stubbornly let it sit for 5 or 6 weeks hoping someone will eventually bite – by that point, you’ve lost more in vacancy than you’d gain by sticking to your number. A local expert puts it this way: if about 20 days have passed with no solid tenant prospects, you’re very unlikely to get your initial asking price without making changes. The market has spoken. The smart move is to adjust quickly: drop the rent a notch, or consider other incentives (more on that next). Even a modest reduction of $25 or $50 can suddenly make your listing pop up in more renters’ search results (those filtering by price) and ignite new interest. Often, that small tweak is enough to turn a stagnant listing into a leased property. The key takeaway is don’t let a vacancy drag on. Set yourself a limit (e.g. “If we don’t have a tenant by day 14, we lower the price by $X or offer incentive Y”). By being proactive, you’ll cut your losses and fill the unit faster – protecting your bottom line.

Consider Incentives vs. Rate Cuts: Sometimes, you might be hesitant to lower the monthly rent, especially if you’ve just raised it or have certain investment numbers to hit. In those cases, think about offering a one-time incentive as an alternative. For example, instead of reducing rent from $2,000 to $1,950, you could advertise “$500 off the first month’s rent” or a “Half-off first month if you move in by XYZ date.” This kind of promotion can attract renters by reducing their upfront cost, without you permanently locking in a lower rate. Many large apartment communities use this trick in slow seasons – they keep the base rent the same but give a concession up front. You can do it too: a move-in special like a discounted first month, a gift card, or included utilities for a short period can sweeten the deal. Just be sure to calculate the math: offering $500 off once is effectively spreading ~$42 less rent over a 12-month lease (and it may be well worth it if it fills your vacancy now). Incentives can be a win-win – the tenant feels they got a deal, and you maintain your target monthly income after that initial break. Another use of incentives is if you’re part-way through a vacancy and don’t want to drop the rent again – try adding a perk: “Apply by next week and we’ll waive the pet fee” or “free lawn care included.” These bonuses can tip a renter in your favor. However, remember that if your price is way above market, incentives won’t completely bridge the gap. Use them when you’re close to the right price but need an extra push. Also, be mindful that an incentive still has a cost to you (it’s effectively coming out of your rent earnings), so it should be weighed similarly to a rent reduction. Often, though, a one-time concession is psychologically more appealing to renters than a slightly lower rent, so it can be a useful tool in your dynamic pricing toolbox.

In essence, dynamic pricing for your Orlando rental boils down to staying flexible and responsive. Charge a premium when conditions allow, and be willing to ease off the gas when the market softens. By using the strategies above – and keeping a close eye on both market comps and your listing’s activity – you can minimize vacancy time and maximize your overall ROI. It’s all about the big picture: sometimes lowering the rent today makes you more money over 12 months. Now, to make this even more concrete, let’s break down an example rent-pricing calendar by month.

Sample Month-by-Month Rent Pricing Calendar for Orlando

To truly illustrate seasonality, here’s a month-by-month breakdown of how an Orlando landlord might adjust rent pricing or expectations. Let’s assume we have a single-family rental home that could fetch around $2,000/month in a perfectly balanced market. We’ll highlight the demand level each month, and how you might tweak your strategy in response:

January: Very low demand. The rental market is still in the post-holiday freeze. Few people are moving right after New Year’s, and many who wanted a winter place have secured it in November/December. If your property is on the market in January, expect a slow trickle of interest. Price-wise, this is the time to be at your most competitive – you might list slightly below your target or be ready to negotiate. A small winter discount (even ~5%) can help lure one of the few active renters. Don’t be afraid to offer incentives (e.g. “move-in special for January”) to get a tenant in. The good news: as January progresses, some renters start planning spring moves, so you may catch early planners late in the month. But overall, January is one of the toughest months to fill a vacancy, with many landlords seeing their listings carry over from the holidays. Plan accordingly by keeping your price attractive and your expectations realistic.

February: Low demand (but slightly better than January). Early to mid-February is still winter slow season. You may see a marginal uptick in inquiries compared to January as more folks turn their attention back to house-hunting after the holidays. Still, inventory often remains higher than demand, so continue a tenant-friendly pricing approach. By late February, a few renters start looking to move by spring, so activity begins to pick up. If you haven’t filled your vacancy yet, try a refresh in your marketing around mid-February – update the listing, maybe adjust the price or highlight a Valentine’s “special” for signing a lease. Your rent might still be, say, $50 under what you’d ask in summer, but that’s okay. The goal is to secure a tenant before March arrives, because once we hit spring, everyone else will list their rentals and you don’t want to be left behind. Bottom line: February is still a month to be cautious on rent hikes – keep it reasonable and focus on getting someone in by early spring.

March: Moderate demand (rising). Spring is arriving, and so are more renters. March often marks the start of the spring ramp-up in Orlando. Families who plan to move over summer may begin looking now to line up a place, and many job relocations start cropping up as companies tend to initiate transfers in spring. If your property is vacant in March, you’re in luck – demand is improving week by week. You can probably hold closer to your target rent (maybe only a token winter discount, if any). Ensure your home is rent-ready and looking its best, because renters have more choices in spring (other landlords start listing now too). This is a good month to test the waters at a fair market rent – you might not command a premium yet, but you shouldn’t need to undercut much either. If you were offering an incentive in winter, you might scale that back now as interest increases. Keep an eye on comps: if similar homes are renting within 2-3 weeks, price yours in line. Strategy for March: price at or just a hair under market to capture the early movers, and be prepared for faster turnaround as we move towards April.

April: High demand. By April, the rental market is in full swing for spring. This is often one of the better months for a landlord: a lot of renters are actively searching (ahead of May/June moves), but the absolute flood of new listings hasn’t yet hit its peak. That means you have a strong audience without being lost in the crowd. Families, in particular, might secure housing in April to avoid the last-minute summer rush – they want leases signed so they can plan moves and school registrations. If your property is up in April, you can be pretty confident in your asking rent. It’s reasonable to aim for your full target rent now. You might even inch $25 or $50 higher than you would’ve in winter, especially if you see many prospects at showings. Use any competitive advantages your home has (school district, new appliances, etc.) as selling points to justify a top-tier price. Typically, homes show very well in April (nice weather, blooming landscaping), which can emotionally win over renters at a slightly higher price. Just remain mindful: the number of available rentals is also growing this time of year, so make sure your price is in line with the competition. But overall, April is landlord-friendly – a great time to fill a vacancy at a solid rent.

May: Very high demand (peak season starting). Welcome to peak season. May is historically one of the busiest months for lease signings in Orlando. School is about to be out, and many leases end in May/June, so there’s lots of turnover. New listings flood the market, but renter demand matches or exceeds it. This is an optimal month to have a vacancy – you’ll get plenty of eyes on your listing. With so many renters actively hunting, you can confidently set your asking rent at the high end of the range for your property. Some landlords even push rents slightly higher in May knowing that incoming renters are trying to lock places down early for summer (and competition among renters is strong). If your home is desirable and well-priced, you might receive multiple applications. Also, keep an eye out for early UCF student inquiries; some students who plan to live off-campus in the fall start looking as early as May for August move-in, and they might be willing to pre-lease if you allow it. When negotiating in May, you don’t need to offer much in concessions – this is the time to be a bit firm on your price, since someone else is likely waiting in the wings. Do make sure your property is really ready to go (fresh paint, maintenance done) because renters have choices and will pick the place that shows the best for the price. But if you’ve done everything right, May can yield one of your highest effective rents of the year thanks to demand.

June: Peak demand. June is often the peak month for moving in Orlando, as early summer hits full stride. By June, families are executing their relocation plans, new graduates are moving for jobs, and students are home scoping out housing for the fall. This month typically sees the highest volume of lease starts and tenant movement. For landlords, June is usually the easiest time to fill a vacancy – sometimes a listing will get rented in just days if priced right. You should absolutely be asking top dollar in June if your property is available. It’s one of the few times you might even experiment with a slightly above-market asking price, knowing that there are lots of eyeballs on rentals now. If you’re ever going to try for a rent increase on a renewing tenant, June is a good bet (they know it’s peak season and that you could replace them fairly easily). That said, remember that even in peak season, renters will compare value: if you go too high, they might still walk. But generally, June supports the highest rents and shortest vacancy times of the year. Make the most of it by marketing widely, responding fast to inquiries (since quality tenants will have many options), and perhaps selecting the most qualified tenant from multiple applications. It’s a nice “problem” to have as a landlord – just don’t get too greedy and scare everyone off. Price it right and enjoy the heavy demand.

July: Peak demand (continued). July in Orlando is also extremely busy for rentals – think of it as an extension of June’s peak. Many leases end in July, and with the new school year about a month away, both families and students are in a housing frenzy to move in time. You can maintain a peak pricing strategy during July. High rents that wouldn’t fly in the winter can be achieved now because renters have a sense of urgency. One thing to note: July is very hot (and rainy), and it’s also the heart of hurricane season. Surprisingly, this doesn’t stop people from moving, but it does mean sometimes tenants might try to negotiate things like move-in dates around storms or they might appreciate any move-in flexibility because of weather. It doesn’t directly affect rent pricing except that extremely hot weather can deter some casual lookers – the serious ones will still be out hunting, though. As a landlord, ensure your home’s AC is working great (nothing kills a deal like a broken AC in July during a showing!). Pricing-wise, feel confident keeping your rent at the upper end. If you listed in June and somehow didn’t rent it out yet, revisit your pricing or marketing – July is not the time to be overpricing, because even in peak, renters will bypass an outlier. If you listed appropriately, you likely did rent it in June or early July. By late July, you might see a slight tapering as many have secured housing, but it’s still strong. Overall, July is prime time – maximize your rent, minimize any concessions, and lock in a good lease while the market is as hot as the weather.

August: High demand, then tapering. August is a bit of a transition month. The first half of August often remains very busy – many families absolutely need to be in place by mid-August since public schools in Orlando usually start around then. Likewise, college students who delayed securing housing are scrambling in early August, so areas near UCF, etc., see a spike in move-ins. For the first couple of weeks, you can treat it like peak season: keep prices robust and expect swift leasing. However, once mid-late August hits, you’ll feel the market momentum slow down. By the third week of August, most family renters have settled because school is in session. You might still catch some late movers or people whose situations changed last-minute, but the volume drops. If your property comes up mid-August or later, adjust your expectations: demand will fall off sharply as we enter September. For an early August listing, go ahead and price it at July levels; for a late August listing, you may want to pre-emptively price a hair lower or be ready to negotiate since the tenant pool is thinning out. Also, note that late August is when a lot of leases begin (from earlier signings), meaning fewer renters actively looking at listings – many have already signed by now. Strategy for August: Front-load your marketing and aim to secure a tenant by mid-month. If you’re showing the home in the first week or two, you can be fairly firm on rent. If it’s sitting as September approaches, consider offering that incentive or slight discount to grab one of the remaining prospective tenants before the fall lull fully sets in.

September: Moderate-to-low demand (post-peak lull). September is typically one of the slower months for rentals in Orlando, coming right after the busy summer. With the school year underway and the big relocation season over, far fewer people are house-hunting. Many who didn’t lock in a summer lease will just stay put until next year, if they can. Listings in September often see fewer inquiries and can take longer to rent out. As a landlord, you should pivot back to a value-driven pricing strategy now. If you try to advertise a “summer peak” rent in September, you might hear crickets. It’s wise to tick your asking rent down a notch (perhaps 2-5% lower than you would have in July) to attract tenants. Also, highlight any features that could appeal to the off-season crowd: for instance, young professionals who don’t care about school timing might be looking now – they might value things like proximity to work or included amenities. This is the time to possibly offer a perk (“free last week of September if you sign now” or flexible lease terms) to differentiate your listing. One thing in your favor: by September, a lot of competing rentals are off the market (rented in summer), so there may actually be fewer units available, which helps your odds if someone is looking. Still, the pool of renters is small. Be prepared for a longer marketing period and build that into your price (e.g. better to list a bit under market and fill by end of September than list high and still be vacant into October). Keep an eye on feedback from showings – if people are saying “it’s a bit pricey for us,” that’s a sign to adjust. Overall, think of September as a mini “reset” after summer – time to work a little harder (and maybe accept a bit less rent) to get the property occupied.

October: Low demand. October generally continues the fall slowdown. Many families and renters settle into leases in September if they had to move after summer, so October can be quiet. It’s also a month where people start getting distracted by upcoming holidays, year-end projects, etc., so unless a move is necessary, they often postpone housing decisions. For an October vacancy, your strategy should be similar to September’s, but potentially even a bit more tenant-friendly as the holidays draw closer. Price competitively and be flexible. By now, you might consider shorter lease options as a selling point (e.g. a 6- or 8-month lease ending in spring) to entice someone who maybe only needs a place through next summer – this can be a great way to avoid being stuck with a vacant home all fall. From a pricing perspective, don’t expect to raise rent in October; if anything, you might be negotiating it down. The good news is that some renters who didn’t find a place in September will still be looking now, and there are usually a few new job relocations in the fall. For instance, a professional moving to Orlando for a job in October might be hunting for a nice rental – and they often need something fast. If you target that demographic (maybe through corporate rental listings or highlighting “easy access to downtown/airport” etc.), you might snag a tenant willing to pay a fair rent without much haggling. Even so, plan for possibly several weeks of vacancy and budget that into your annual expectations. If the home is still unrented as Halloween approaches, consider doing a significant move-in special for November 1 (because November/December will only get slower). In summary, October is a slow month so your rent pricing should be conservative. It’s about filling the space and positioning yourself for a stronger season ahead, rather than squeezing out top dollar.

November: Very low demand. November marks the start of the true holiday season, and renter activity tends to hit its nadir. By mid-November, folks are busy with Thanksgiving plans and then winter holidays – moving is the last thing on most people’s minds. Additionally, many landlords avoid listing in November, so the market has fewer listings and fewer renters. If you have a vacancy now, you’re in a tough spot, but not an impossible one. First, price your rental to move quickly. This likely means setting the rent noticeably below what you’d get in summer – possibly on the order of 5-10% lower. For example, that $2,000/mo house in July might need to be $1,850 or $1,800 in November to garner interest. Remember that earlier Homevest example: a home renting for $1,500 in June might only fetch ~$1,200 in December – November is similar. These kinds of seasonal drops can be what it takes to avoid sitting vacant into the new year. Second, double down on incentives and flexibility. Be open to shorter leases (e.g. a 7-month lease ending in June, which many renters might actually prefer if they too want to align with summer moving forward). Advertise perks like “November move-in special – half off first month” or consider including some utilities or services to sweeten the deal. You want your place to be the obvious choice for anyone who does need a rental now. Who might that be? Possibly people relocating for a job that starts in January (they might come in December and overlap), or someone who sold their house in fall and needs a rental, or occasionally a family that must move due to circumstance. These renters exist, but they will gravitate to the best value. So make sure your pricing sends the message: “Great home, great deal, available now – skip the hassle and move in before the holidays!” On the plus side, if you secure a tenant in November, you can often get a longer lease term out of them (since few want another lease ending in holiday season next year). You might lock in, say, a 14- or 15-month lease through the following winter or spring, which protects you through the next slow season. All told, November is all about being proactive and generous in your pricing/terms to land one of the few fish in a small pond.

December: Extremely low demand. This is it – the quietest month of the year for rentals. December is dominated by holidays, travel, and year-end commitments; almost nobody wants to move in mid-December, and many who would need to have already arranged something by now. If your property is on the market in December, you should treat it as an urgent matter to get it filled (because every day vacant now is essentially lost revenue with minimal offsetting interest). Pricing in December should be at its most competitive. You’re likely looking at the bottom of your pricing range for the year. It’s better to have a tenant at a discounted rate than see the home sit empty until January or February. For example, if you’ve been holding out at $1,850 in November with no luck, dropping to $1,750 in December (or adding a bigger incentive) might finally snag a tenant who was on the fence. You might effectively be taking a 10% winter discount, but doing so could save you from a vacancy that costs much more. Another tactic in December is to market for the New Year – some renters will plan a move over the very end of December into early January. So you might advertise “Available January 1 (or last week of December) – lock in now and start your new year in a new home!” That way people who are looking to move right after New Year’s might commit in December. Still, expect very few leads. If someone does inquire, follow up immediately and be ready to accommodate their schedule (perhaps they’re only in town one weekend to look, etc.). Safety tip: around the holidays, people’s finances can be tight (gifts, travel expenses), so if you do lower standards to fill the place, be cautious and still screen tenants carefully – it’s not worth taking a truly unqualified renter just to fill December, because an eviction or non-payment will hurt more. But you might, for instance, accept a slightly lower credit score or a shorter employment history if everything else checks out, given the limited applicant pool. Lastly, consider whether you want to do any off-season maintenance now – some owners purposely don’t list in late December and instead do upgrades, then list in January. If you haven’t found someone by mid-December, you might decide to take it off-market for a couple weeks, do that repaint or appliance replacement, and re-launch in January with a fresh look (sometimes at a higher rent). It’s a bit of a gamble, but if zero people are biting in December, it could be a better long-term move. Overall though, if you’re holding a vacant unit in December, price it to fill ASAP. Every rent dollar you don’t collect this month is gone forever, and you’re better off securing a tenant now – even at a discount – so you can start the new year with occupancy.

As you can see, rent seasonality in Orlando means you’ll want to adjust your pricing and approach month by month. The differences can be dramatic – from hardly any movement in the winter holidays to bidding wars in the summer. By anticipating these patterns, you can prepare and avoid unpleasant surprises (like that realization that no one is calling about your December listing, or conversely, that you listed too low in July and got 20 inquiries in an hour). The above calendar is just a guide – every year and every neighborhood can vary – but it captures the general flow. Always keep an eye on current market data and talk to local experts if unsure.

Maximizing ROI Year-Round (Conclusion)

In the end, dynamic rent pricing in Orlando is about strategy and timing. By understanding the seasonal demand shifts – from the school-year rush to the holiday lull – you can make smart decisions that keep your rental income flowing steadily. Rather than sticking to a rigid price, you’ll earn more in the long run by adapting to the market: ask a bit more when the odds are in your favor, and be willing to take a little less when the market cools off. This proactive approach prevents long vacancies and improves your overall return on investment[2][3].

A few final tips to remember:

Plan Ahead: Try to align your lease expirations with peak seasons. A well-timed lease (ending in summer) sets you up for success, whereas a poorly timed one (dead of winter) can be an uphill battle.

Stay Informed: Keep tabs on local trends – Are lots of new apartments opening this spring (more competition)? Is a major employer expanding or contracting? Local events like a big convention or a new campus opening can temporarily boost demand. The more you know, the more you can adjust proactively.

Be Flexible and Creative: Whether it’s adjusting the rent, offering a move-in special, or doing a 10-month lease, use the tools at your disposal to meet the market. The ultimate goal is zero vacancy and maximum rent – sometimes that means thinking outside the 12-month, full-price box.

Think Annual Income: Don’t fixate on getting the absolute highest rent each month; focus on the total rent collected over the year[4]. It’s often better to take a small hit on monthly rate if it ensures you have a paying tenant for 12 out of 12 months. Occupancy is king – an occupied property at a slightly lower rent will always beat an empty one at a “dream” rent.

By implementing these strategies, you’ll find that you can significantly reduce your vacancy losses and improve your rental’s profitability, all while staying competitive in the Orlando market. Dynamic pricing is not about being inconsistent or unpredictable – it’s about being strategic, data-driven, and responsive to the predictable seasonal cycles.

Want help timing your lease start to the perfect month? Or unsure how much to adjust your rent for an upcoming slow season? Ask us about a seasonal pricing strategy for your Orlando rental. At Ackley Florida Property Management, we specialize in understanding the local market nuances – from UCF’s calendar to Disney’s seasonal trends. We’re happy to analyze your property and recommend the best timing and pricing approach to maximize your ROI (and sanity!). Dynamic rent pricing can feel like a balancing act, but you don’t have to walk the tightrope alone. Contact our team for expert guidance on setting the right rent at the right time. With the right strategy (and a bit of flexibility), you can keep your Orlando rental occupied and profitable all year round – winter, spring, summer, and fall.

[1] [2] [3] [4] Vacancy Math: When a $50 Discount Beats a Month Empty (With Calculator)